Asset purchase vs share purchase

A purchase or sale of a business involves legal, tax, operational and strategic considerations.

When an purchaser ("Acquirer") is buying a business, the tax implications of the transaction have to be considered. It is important for the acquirer to make the proper income and sales tax due diligence of the target before proceeding.

For the seller, he will look to maximize the net value of the transaction.

The most tax efficient way to sell a business (or buy one), while minimizing the legal liabilities attached to the target business ( "Target") is to first understand the type of transaction available to the acquirer and seller:

Asset sale

Share sale

What is the difference between an asset purchase vs. stock purchase?

An asset sale involves acquiring the different classes of assets needed to operate the target business, without necessarily assuming the liabilities.

These assets include equipment, licenses, goodwill, customer lists, and inventory.

When purchasing assets of the business, the acquirer does not gain control of the target. Instead, it will either rollover the assets into a new business or operate them in its existing business.

The target is then left with the purchase price consideration, as well as the existing liabilities at the purchase date.

A control position happens when more than 50% of the voting common shares of a business are held. Therefore, a potential purchaser does not need to necessarily acquire 100% of the common shares of a target to obtain control of its operations.

However, share sale involving privately held small to medium businesses typically are for a 100% of the voting common shares of a business.

With this change of ownership, all liabilities of the target business are also assumed by the acquirer.

Asset transaction

For the buyer

Buyers will prefer purchasing the assets of a business. This is because it involves less potential liabilities, is more tax efficient and the acquirer can pick and choose which asset he wants.

Because the seller remains the legal owner of the target company, all liabilities remain with him, which in turn reduces the risk significantly for the acquirer.

Also, income taxes can be minimzed by using tax amortization on assets. The acquirer can choose the tax cost of the individual assets, which is normally their fair market value, on which to apply capital cost allowance (CCA).

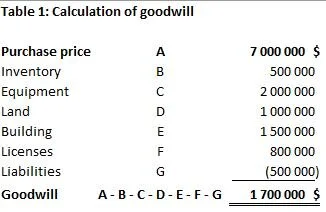

It is important to note that one of the assets the acquirer will buy is goodwill. This goodwill is typically not listed on the target's balance sheet and will need to be determined.

Goodwill, which is classified as an intangible asset (Class 14.1), can be amortized at a yearly rate of 5%, whereas equipment, which is classified as a tangible asset (Class 8) can benefit from tax deductions at a yearly rate of 20%.

For the seller

An asset transaction involves many tax considerations for the seller, which is why they will prefer a share transaction, unless the corporation has unutilized tax losses that may be applied to offset income generated on an asset sale.

When a corporation sells its tangible assets, it can either incur a

Taxable business income

Taxable business loss

Taxable recaptured depreciation

Taxable capital gain

Taxable capital loss

Business income is taxed at the corporation's normal tax rate on active income.

Capital gains benefit from a 50% tax break. The other 50% is taxed at the normal rate for investment income. If, however, the corporation incurred a capital loss on the sale of its assets, it can use it against its capital gains to reduce income taxes in the current year.

You cannot have a capital loss on the disposition of depreciable property or personal use property.

Another consideration for the seller is how the proceeds available for distribution will be distributed to its shareholders. Once liabilities have been paid off, the seller will want to maximize the money available.

This is done by choosing the type of dividend to distribute to its owners, which also have tax considerations.

Finally, the refundable dividend tax on hand account (RDTOH) also needs to be used.

Share transaction

For the buyer

When the acquirer purchases the shares of a business, he inherits all assets and liabilities of the business at their original undepreciated capital cost (UCC).

The acquirer will not have the opportunity to trim down unwanted assets. In this case, a proper due diligence of the business will need to be undergone to understand the legal, tax and operational liabilities of the business.

Once all elements are understood, it is then possible for the buyer and seller to negotiate a fair price.

The risk involved for the buyer in a share sale are much higher than an asset sale.

For the seller

A vendor’s preference for a share sale is usually based on the availability of the capital gains exemption and the reduced rate of tax eligible on capital gains.

A lifetime capital gain exemption exists at for shareholders of a Canadian Controlled Private Corporation (CCPC). The limit of this capital gain exemption is 892 218$ (2021) and is decreased everytime the shareholder uses it. In order to be eligible for this capital gain exemption, several criteria's need be respected:

Needs to be a CCPC

All, or substantially all, of the company’s assets must be used in an active business carried on primarily in Canada (>90%)

The disposed share must have been owned by the shareholder or a related person throughout the 24-month period prior to the disposition

Throughout the 24 months prior to the disposition, the corporation had to have been a Canadian-controlled private corporation and more than 50% of the company’s assets had to have been used in an active business carried on primarily in Canada.

The vendor will also usually avoid asset recaptured depreciation on a share sale.

Conclusion

Buying or selling a business requires a thorough understanding of the target's operations, tax and operational liabilities. Before proceeding with an acquisition, the acquirer will need to push for an asset sale while the seller will want to maximize its net value. This will lead to negotiations that will be incorporated in the purchase price agreement.

An asset sale will help the acquirer to maximize its capital cost allowance on the undepreciated capital cost of assets. The acquirer will also avoid most of the risk associated with the liabilities and unwanted assets.

A share sale will benefit the seller who will want to use the lifetime capital gain exemption. It will also be easier to cash out from the business and not incur additional tax liabilities on the capital gains and depreciation recaptures.

Learn the mistakes to avoid when creating your business plan. This article offers tips for developing an effective business plan for your company or venture.