Business plan Canada: raise financing or attract investors

What is a business plan?

A business plan is a standard document requested by many authorities that clearly outlines the roadmap to your business success.

Instead outlining a clear timetable to reach their objectives, many entrepreneurs starting a business prefer launching their small business immediately. This lack of proper market research and understanding of the industry leads many start-ups to failure.

Writing a good business plan will align your business ideas with market realities, providing clarity to many aspects of business operations. By leveraging this strategic process, you will be able to set measurable objectives and benchmark your progress over time.

Because writing a business plan can take some time, it is advised to start the process as soon as possible.

Purpose and use

Drafting a business plan is needed in many situations.

Business planning: Whether you are building your business or expanding to new markets, most successful entrepreneurs will plan ahead. This helps provide clarity to your unique value proposition and disrupt markets more efficiently. By understanding your market positioning, strengths, weaknesses, opportunities and threats, you will be able to anticipate future outcomes. By outlining key performance indicators and financial goals, the math will be confirmed.

Raise financing or attract investors: Many start-ups will seek financing to cover high investments in CAPEX and expenses. Financial institutions and private lenders will require several documents to measure their financial exposure to your business. Such documents will include a detailed business plan. Also, when combined with a well-prepared elevator pitch, angel investors will be more willing to invest.

Register a regulated business: Many Canadian business ventures are regulated by public authorities. For example, this can be the Authority of Financial Markets or the Minister of Education. These entities demand to have a detailed presentation of the project in order to grant a license to conduct business.

Each reader will have specific items that will grab his interest.

Lenders: They will be interested in knowing if your business can repay the loan over time. In case of a downturn, they will want to know if you can personally guarantee the loan with your personal assets.

Investors: They will be interested to maximizing their return on investment (ROI).

Regulators: They will mostly be interested in your business and financial model. They will want to know if you will respect all laws and regulations in your industry.

Key drivers

The manner in which you will create the business plan will be crucial. Ultimately, you will want to grab the attention of the reader and compel him to invest in your project. This is done by demonstrating complete mastery of your business finances, industry, competition, products, services and other factors.

Drafting a solid business plan demands strategic thinking, creative writing and logic. It is a question of finding the right balance between selling the project while explaining the risks in a logical manner.

Strategic thinking: Showcasing the relevant indicators of success will be crucial. Each sections of the plan will need to add value and complement each other. A detailed writing plan will need to be thought out and implemented.

Creative writing: Tonality, syntax and professionalism will be two key drivers to a successful business plan. The originality of your content will be an attention grabber.

Logical thinking: Elements presented in each section will need to be cascaded to the next section. Assumptions, which should be realistic and achievable, will be used as the basis for the financial forecasts and key performance indicators.

Market research

Market research is one the most time consuming area of a business plan, yet the most important skill to have.

Although the goal is to sell the business, this must be done based on real statistics, assumptions and backed by research. By providing supporting references and sources, the level of professionalism and the quality of the work will immediately be recognized.

The challenge in itself is to dissect these sources of data and summarize the relevant information. It takes experience to effectively research the market.

Several databases exist on the market to gather specific data on industry trends, market segments, financial benchmarks and so forth.

Z&N Valuations has access to these databases through are solid network. Our ability to gather, analyze and use the data collected is an unrivaled strength that our team possesses.

Sections of the business plan

There are no rules dictating which sections should be included. However, we believe the following sections will contribute to drafting a solid document.

Executive summary

The executive summary will be the first section read and should quickly grab and retain attention. Considering investors read many investment documents in a day, their attention span is usually limited to a 15-minute window. A well drafted executive summary will propel the interest of the reader to the next sections.

We should find a recap of the entire document, starting with the nature of the project. Showing the financial forecasts and the amount requested is also a must. Profitable financial forecast is usually a great starting point for the reader.

Company overview

This section will identify in more details the nature of operations, products and services. As well, it is in this section that the company’s mission, vision and values will be stated. By knowing the core activities of the venture, an investor will have a general sense of the risks and opportunities.

Industry overview

This section will present the trends and growth drivers impacting your industry. The goal to demonstrate historical tendencies and projected growth. As well, showing how your business will capitalize on these trends will be necessary. The reader will be looking for growth opportunities.

Market analysis

The objective of this section is to demonstrate how your business gain a competitive market positioning and market shares. With a SWOT (strengths, weaknesses, opportunities, threats) analysis, the reader will gain a thorough understanding of your competitive advantages. This is where your business will demonstrate its unique value proposition and benchmark it against the existing competition.

Sales and marketing plan

After demonstrating your unique value proposition, it is time to prove how you will deliver on this. How you will generate your revenues and gain market shares will be an important component to the reader. You should be able to define clearly your target audience and segment with the market. The level of details about your customer knowledge will speak volumes.

Furthermore, your pricing strategy will be of interest too.

Business team

This section will present the experience, relevance, positions, titles and responsibilities of the management team. Clearly stating past accomplishments of each individuals and how they will translate into managing a successful new venture will be key. The reader will want to know who he is dealing with.

Operating plan

The operating plan will demonstrate the business model and its coherency. Each operating unit and activities should bring added-value to the business and its bottom line. The reader will be interested to know the level of CAPEX needed and if activities are relevant to core business operations.

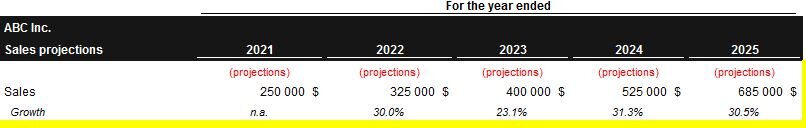

Financial forecasts

Finally, this section will be the most important to the reader. You will need to demonstrate the bottom line of your business within the next few years. Usually, forecasts are made on a 5-year basis.

An investor will also want to know your exit strategy. This is because, as mentioned previously, he is looking for a return on investment above a certain threshold.

Financial forecast will need to reflect the impact on:

· The profit and loss statement;

· The balance sheets; and

· The statement of cash flows.

As well, a lender will be interested to know whether you respect certain financial ratios such as the

· Debt servicing ratio;

· Debt-to-equity ratio; and

· Current ratio.

Appendix

Market studies, financial forecast schedules and sources will be of benefits to the reader. A business plan is only as strong as its market data and assumptions. By collecting and displaying proper research papers, you will gain the trust of the reader.

Our expertise

Z&N Valuations has helped multiple small and medium business owners by drafting converting business plans. We distinguish ourselves from the competition by our smooth process and strategic thinking when drafting the plan. Our strengths rely in clearly showcasing the investment opportunity to a lender and logically explaining the return on investment.

The work of our business plan writers has been recognized by many financial institutions. High-converting business plans means that we minimize lenders worries and questions. We make it clear that this is a good investment opportunity.

If you would like us to help you draft a solid business plan, feel free to contact us. We also provide free business plan templates.

Learn the mistakes to avoid when creating your business plan. This article offers tips for developing an effective business plan for your company or venture.