The pitch deck creation process.

What is a pitch deck?

Are you raising money for your start-up or business idea? You will need to create a pitch deck.

This document is a brief presentation using a professional document that clearly presents your business in a concise manner. It is usually delivered through a live presentation to investors. It should not be more than 23 pages long.

It is important to differentiate this presentation to the pitchbook. The pitchbook is a more detailed document that presents your business in all its aspects to potential investors. It will dive deeply into your business model, valuation, financial forecasts and so forth. The pitchbook is usually delivered through emails and printed for lecture and analysis.

In contrast, the deck is more about pictures and styling than content. Although you should develop on specific sections at a minimum, because you have a time constraint, the deck must attract attention through powerful illustration and deliver your point across.

How to build a pitch deck?

As mentioned, this business presentation is used during an elevator pitch during investor relations activities. 20 minutes is usually the target time for a pitch. The clearer the document, the more successful pitching will be. The document needs to speak volumes, while staying concise.

One of its most important elements is its presentation. A perfect business deck needs:

1. Aesthetics

2. Designs

3. Logic and structure

It is imperative for your start-up to project a professional image to investors. The quality of the document will differentiate your business from the pack and will tell investors that you are taking this seriously. Originality must also be taken into consideration in order to retain the investor’s attention. Because they get pitched so many ideas, the attention span of the investor is limited. You window of opportunity being small, you must retain attention faster.

Although the deck is designed for investors, the presentation will depend on the audience and type of investor. An e-commerce website seeking investment will present a different deck than a real estate business.

Also, specific sections of your deck are more important than others. For example, the financial section is one that investors will spend the most time on. They will want to know what your profit margins are as well as your growth opportunities.

What should a pitch deck include?

1. Nature of business

What exactly does your business do? Investors should grasp in the first moments of your presentation the purpose of your business. This is usually done following the following logical structure:

Team slide

Starting with a presentation of the management team and its founders is always a good idea. This establishes a personal connection with your audience. Venture capitalists will want to know who they are dealing with.

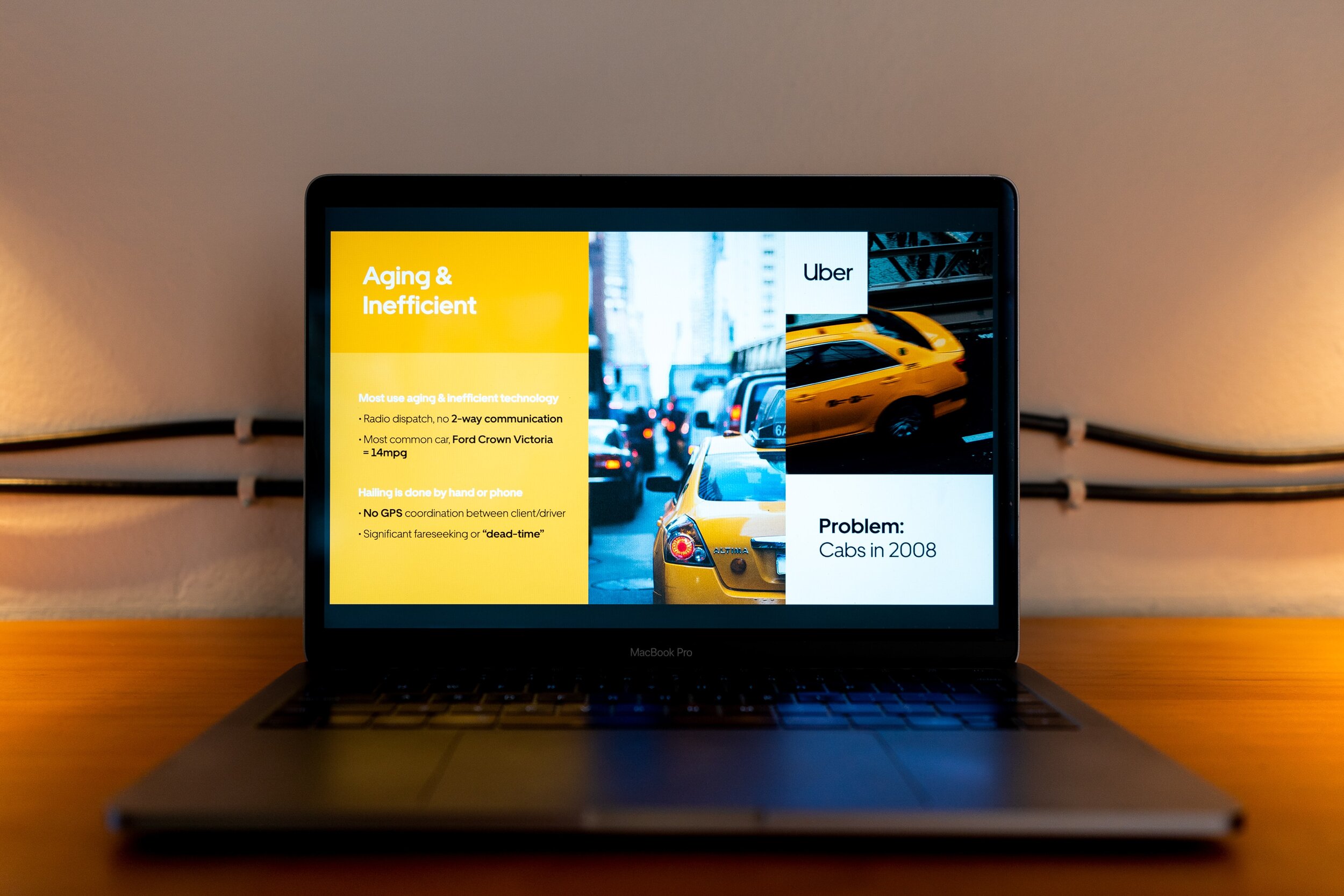

The problem

What problem is your business trying to solve? What gap are you filling in the market? Usually, entrepreneurs start a business to either

a) Solve a problem currently existing in the market

b) Enhance an existing business model

c) Disrupt an existing business model

The first few pages of the presentation should be focused on this. The business should also make it clear that they are only focused on a single problem. Having multiple problems to solve dilutes the competitive advantage of a business and reflects an unfocused business model.

The solution

How are you solving the above-mentioned problem? Investors will be interested in your unique value proposition. This means that your solution not only needs to fill a gap on the market, but has to do it in a manner that is different from the competition.

This section should focus on how your service or product solves the pain points of customers. It is particularly important to demonstrate a solution that solves many if not all of customers pain point. This will certify its uniqueness and raise its authority among investors.

The market

This section will focus on the market and industry trends. The goal is to show how your business is taking advantaged of new trends and tendencies. Not only should your offer carve its spot among the competition, but it should benefit from a competitive differentiator. By analyzing the market strengths, weaknesses, threats and opportunities, it will be easy to demonstrate the benefits of your solution.

Product or service

Your audience should have a solid understand of your product or service. Because this is at the forefront of any investment, describing the key features and benefits of your product or service will be important. What is your product or service? How does your product or service work? What is the average life of your product or service? What is the cost to market your product or service?

2. Business model

The business model can make or break your pitch. This section is an overview of your business and should have a special focus on how you will bring the products and services to market, who are the key partners and people involved, what is the infrastructure needed, which segments will be targeted, who are the competitors, what are your revenue channels, and other relevant items.

3. Growth opportunity

Investors will be interested maximizing their return on investment (ROI). For this to be done, their should exist some growth opportunity for your business.

Actual situation

Since inception, what have you realized? What are the key metrics that you have been able to follow? For example, this can be the number of users on your platform, the number of orders, active users, and so forth.

Expansion plan

Are there any new customer segments to target? Can you diversify your product or service offering? How are you planning to increase brand awareness and customer experience?

Type of customers

Showcasing your understanding of customers is crucial. There should be a focus on customer preferences, behavior and attributes. Who is your ideal customer avatar? How are customers segmented? What is your strategy to target each segment?

4. Financials

The financial section of your pitch deck is the most important. Investors will pay special attention to your key financial indicators as well as your projections. Not only to maximize their return on investment, but also to know whether you can reinvest your excess cash flow to make your business grow to new levels.

Forecasts

Forecasting the income statement, balance sheet and cash flow will be essential. The forecasts should be tied to the assumptions you have presented in previous sections. Investors will be interested in positive and growing trends. Technically, a 3 to 5 years projections should suffice. However, some institutional investors can ask for more than 5 years in order to evaluate their investment horizon and exit strategy. The relevant indicators will be

· Revenue;

· Gross profit;

· Operational expenses;

· EBITDA;

· Adjusted EBITDA.

Amount asked

Many pitch decks forget to include this slide deck. Your audience are investors that will be pouring inflows of cash into your business. They will need to know how much money you are seeking in exchange for equity. Institutional investors will almost always come back with a lower counter offer. You should therefore be strategic with the amount asked and be ready to negotiate.

Sources and uses of funds

It is important to mention how the funds injected will be used. Investors will want to know that you are using their investment to growing your business. This can be through infrastructure investments, marketing activities or hiring key staff. In either case, the pitch deck should demonstrate a clear goal to seeking investments.

Our expertise

Zen Valuations is an online platform providing financial advisory services with experienced management consultants that have helped multiple small to large businesses reach their financial goals with financial modeling consulting services. We distinguish ourselves from the competition by our smooth process and strategic thinking when building pitch decks and financial forecasts. Our strengths rely in clearly showcasing the investment opportunity to a lender and logically explaining the return on investment.

As well, the work of our business plan writers and financial forecasters has been recognized by many financial institutions. High-converting pitch decks means that we minimize lenders worries and questions. We make it clear that this is a good investment opportunity. If you would like us to help you draft solid pitch deck, feel free to contact us.

Learn the mistakes to avoid when creating your business plan. This article offers tips for developing an effective business plan for your company or venture.